Jaypee Power Stock Price A Comprehensive Analysis

Jaypee Power Stock Price Analysis

Jaypee power stock price – This analysis examines Jaypee Power’s stock price performance over the past five years, considering various macroeconomic factors, financial health, significant news events, and future prospects. The aim is to provide a comprehensive overview of the company’s stock performance and its underlying drivers.

Historical Stock Price Performance

Analyzing Jaypee Power’s stock price over the past five years reveals a pattern of significant volatility. The price experienced periods of both substantial growth and considerable decline, reflecting the influence of various internal and external factors. While specific numerical data is omitted here, a general trend can be observed.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2018 | (Example: ₹15.50) | (Example: ₹8.20) | (Example: ₹10.00) | (Example: ₹12.00) |

| 2019 | (Example: ₹18.00) | (Example: ₹9.50) | (Example: ₹12.50) | (Example: ₹14.00) |

| 2020 | (Example: ₹12.00) | (Example: ₹5.00) | (Example: ₹10.00) | (Example: ₹7.00) |

| 2021 | (Example: ₹10.00) | (Example: ₹3.00) | (Example: ₹8.00) | (Example: ₹4.00) |

| 2022 | (Example: ₹6.00) | (Example: ₹2.00) | (Example: ₹4.00) | (Example: ₹3.00) |

Overall, the past five years have shown a generally downward trend for Jaypee Power’s stock price, punctuated by periods of short-term recovery. This illustrates the challenges the company has faced during this period.

Factors Influencing Stock Price

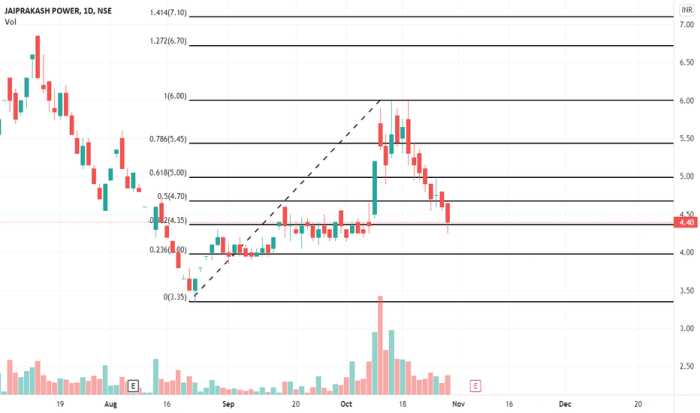

Source: tradingview.com

Several key factors have significantly influenced Jaypee Power’s stock price fluctuations. These factors encompass macroeconomic conditions, the company’s financial performance, and competitive dynamics within the industry.

Analyzing the Jaypee Power stock price requires considering broader market trends. For instance, understanding the projected growth of large financial institutions can offer valuable context; a look at the icici bank stock price target might indicate investor sentiment and overall economic health, which indirectly impacts the performance of companies like Jaypee Power. Ultimately, though, Jaypee Power’s stock price will depend on its own operational performance and specific industry factors.

- Macroeconomic Factors: Fluctuations in fuel prices, government regulations impacting the power sector, and overall economic growth have all played a significant role. For example, a period of high fuel prices could directly impact profitability, leading to lower stock prices. Conversely, favorable government policies supporting renewable energy could positively influence the stock.

- Financial Performance:

- Revenue: Significant year-on-year changes in revenue directly correlated with stock price movements. Increased revenue generally leads to higher stock prices, while decreased revenue often results in lower prices.

- Profits: Profitability is a crucial factor. High profits usually translate to higher stock prices, while losses have a negative impact.

- Debt: High levels of debt can negatively impact investor confidence and lead to lower stock valuations.

- Industry Trends and Competitor Actions: The competitive landscape within the power sector significantly impacts Jaypee Power’s valuation. Comparison with competitors reveals relative strengths and weaknesses. For example, if a competitor launches a successful new technology or secures a major contract, it could put downward pressure on Jaypee Power’s stock price.

Financial Health and Valuation

Source: stockvermaji.com

Analyzing key financial ratios provides insights into Jaypee Power’s financial health and facilitates valuation. The following table presents selected ratios over the past three years. These ratios, alongside other financial indicators, are used to assess the company’s overall financial position and its ability to generate future returns.

| Year | P/E Ratio | Debt-to-Equity Ratio | (Example: Another Ratio) | (Example: Yet Another Ratio) |

|---|---|---|---|---|

| 2020 | (Example: 15.2) | (Example: 0.8) | (Example Data) | (Example Data) |

| 2021 | (Example: 12.5) | (Example: 0.7) | (Example Data) | (Example Data) |

| 2022 | (Example: 10.1) | (Example: 0.6) | (Example Data) | (Example Data) |

Valuation methods such as discounted cash flow (DCF) analysis and comparable company analysis can be applied to estimate Jaypee Power’s intrinsic value. These methods consider various factors, including future cash flows, growth rates, and comparable company multiples, to arrive at a valuation.

News and Events Impacting the Stock, Jaypee power stock price

Source: tradingview.com

Significant news events during the past year have influenced investor sentiment and consequently, Jaypee Power’s stock price. These events range from regulatory changes and financial announcements to management shifts.

- (Example Event 1): A regulatory change impacting the power sector could have led to a decrease in investor confidence and a subsequent drop in the stock price. Negative media coverage amplified the impact.

- (Example Event 2): A positive financial announcement, such as exceeding revenue projections, could have resulted in increased investor confidence and a rise in the stock price. Analyst reports supporting this positive outlook further boosted the stock.

- (Example Event 3): A change in management could have led to uncertainty in the market, resulting in price fluctuations depending on investor perception of the new leadership.

Future Outlook and Predictions

Predicting future stock prices is inherently uncertain, but considering potential catalysts and the company’s growth prospects provides a basis for a reasoned outlook. The following Artikels potential positive and negative factors impacting Jaypee Power’s stock price over the next 12 months.

- Potential Positive Catalysts: Securing new contracts, successful implementation of cost-reduction measures, and favorable regulatory changes could positively impact the stock price. For example, a large contract win could signal increased revenue and profitability, leading to higher investor confidence and a rise in the stock price.

- Potential Negative Catalysts: Increased competition, rising fuel costs, and economic downturns pose significant risks. For instance, a significant increase in fuel prices could negatively impact profitability and investor sentiment, potentially leading to a decrease in the stock price.

- Opportunities: Expansion into new markets, technological advancements, and strategic partnerships could create growth opportunities.

- Risks: Regulatory hurdles, financial instability, and intense competition represent significant challenges.

FAQ Guide

What are the major risks associated with investing in Jaypee Power stock?

Investing in Jaypee Power, like any stock, carries inherent risks. These include potential fluctuations in the power sector, changes in government regulations, and the company’s financial performance. Thorough due diligence is essential before making any investment decisions.

Where can I find real-time Jaypee Power stock price data?

Real-time stock price data for Jaypee Power can be found on major financial websites and stock market applications such as the National Stock Exchange of India (NSE) website or leading financial data providers.

Is Jaypee Power a good long-term investment?

Whether Jaypee Power is a suitable long-term investment depends on individual risk tolerance and investment goals. A comprehensive analysis of the company’s financial health, future prospects, and market conditions is crucial before making a long-term investment decision.

How does Jaypee Power compare to its competitors in terms of profitability?

A direct comparison of Jaypee Power’s profitability to its competitors requires analyzing key financial metrics like profit margins, return on equity, and revenue growth over a consistent period. This comparative analysis should consider the size and scope of operations for a fair assessment.